September MQAC Webinar

Talking points: Tips on how to check your processes and prep for a CA state exam

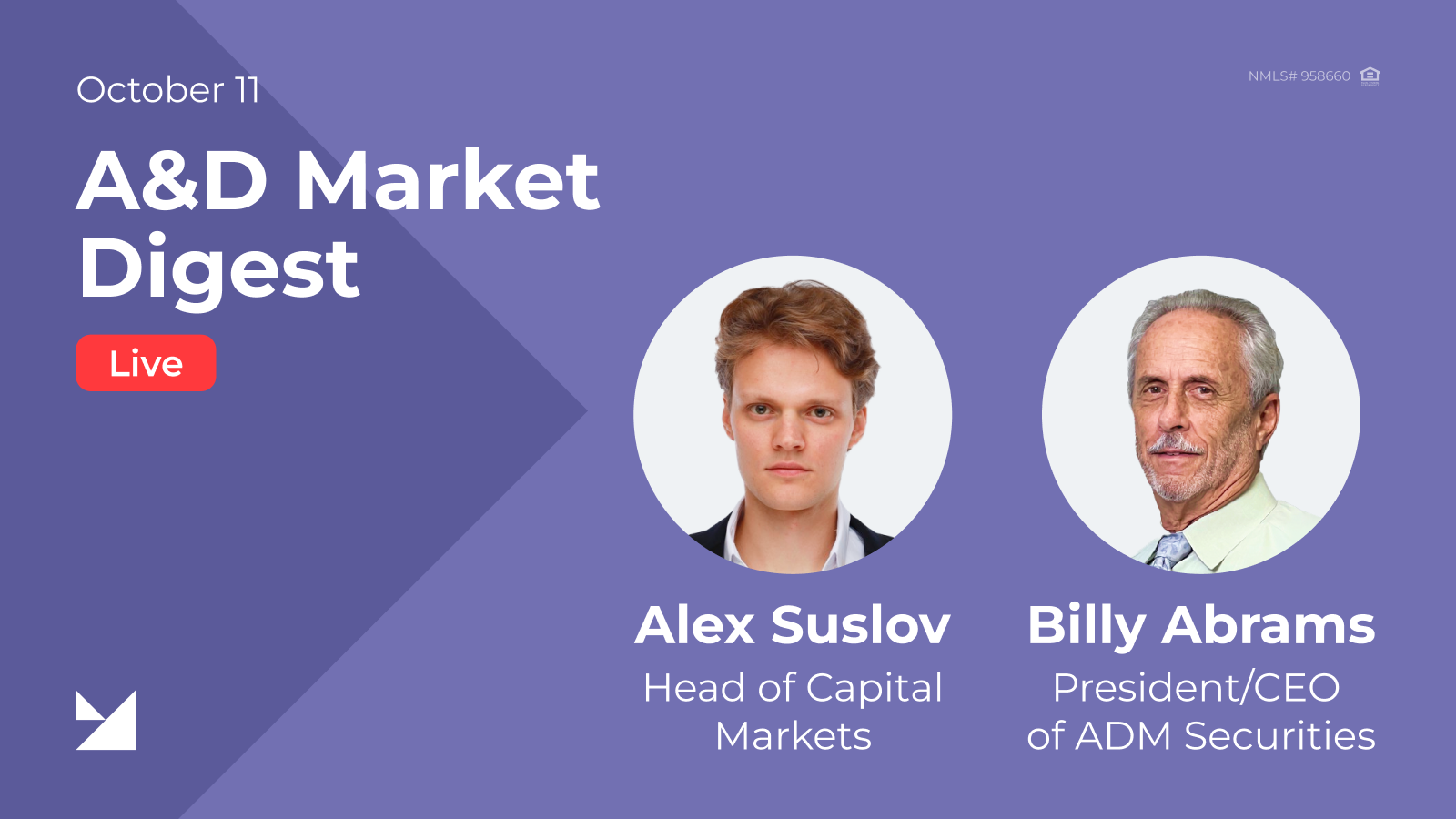

A&D Market Digest Live

Join us for A&D Market Digest Live! Alex Suslov, Head of Capital Markets, and Billy Abrams, President/CEO of ADM Securities, will discuss recent and upcoming trends happening in the capital markets and their impact on the Non-QM market. You’ve watched them every week, so now you get to ask them your burning questions in person! Register Now: https://zoom.us/webinar/register/WN_kp14XTseRhuldgvvKn6k-w

AD Studio – The Best Marketing Platform for Mortgage Brokers

Join us for a live demonstration and Q&A on designing professional marketing materials with AD Studio. It makes it easy for brokers to create professionally designed marketing materials — flyers, postcards, social media, etc. — from your desktop or your phone. Register Now: https://zoom.us/webinar/register/WN_0kZUVkqCR-u5eQH-hs9suQ

October DEI Webinar

A discussion of appraisal bias, its history, current trends, and what lenders can do. Speakers: Genail Nemovi, President & Managing Attorney, Nemovi Law Group Amanda (Mandy) Phillips, EVP of Compliance, Aces Quality Management

November DEI Webinar

Listen in to hear how Woody White successfully developed the diversity program at Homebridge and is working to extend the opportunity of homeownership to all members of all communities, particularly underserved communities to ensure access and equality. This will be a very engaging webinar, so please come with any questions you may have for Woody! Speakers: Brian "Woody" White, Chief Diversity & Inclusion Officer, Homebridge

Tapping the Potential of SPCPs: A Hands-on Workshop for Mortgage Lenders

Through roundtable discussion and a hands-on practicum, “Tapping the Potential of SPCPs: A Hands-on Workshop for Mortgage Lenders” will give attendees the skills and confidence necessary to develop and launch successful Special Purpose Credit Programs while earning points toward their Certified Mortgage Banker (CMB) designation from the Mortgage Bankers Association (MBA). ● Mosi Gatling, Sales Manager, loanDepot● Jason Fraley, SVP & Community Lending Director, Huntington Bank● Evan Zuverink, CRA Officer, First Commonwealth Bank● Lindsay Cannaday, […]

Fannie Mae Calibrations Overview & How to Prepare – November MQAC Webinar

Talking points: Beginning in the 4th Quarter of 2022, Fannie Mae will conduct Quality Control (QC) calibrations of their lender partner’s QC results for review accuracy and assigned severity levels on a regular basis across the industry.

Experts Roundtable: Where is Non-QM Headed in 2023?

It's been a whirlwind year in the world of non-QM mortgages, and there's no better time to take a step back and review everything that's happened than at our end-of-year webinar on January 24, 2023 at 1 PM EST We'll be joined by leading industry experts who will share their insights on what went down in 2022 and what we can expect in the coming year:— Max Slyusarchuk— Rob Chrisman— Derick Mildred— Alexander Suslov— Billy Abrams— […]

SCIF Form & What the Consumer Language is

Talking points: • How to develop a strong limited English program• As a compliance team, how do you perform oversight?• Implementation: IT, scripts, forms, training• What happens if you purchase the loan Correspondent?• How it impacts all the way through servicing?• What do we think the exposure will be down the road from a liability perspective?

Optimizing Loan Quality and Navigating the Next Wave of Buybacks

Talking points: 1. Why Quality Control shouldn’t just be treated as a necessary evil, but rather a business intelligence tool to improve your profits2. The importance of manufacturing quality loans in a down market3. Recent Fannie Mae Pre-Funding and Post-Closing QC changes